Is debt holding you back?

Plan Your Next - Letter No. 3

Hello!

I hope you had a great week. It’s been incredibly hot here, hitting 110 last weekend. Thankfully, it’s a dry heat. 😑

I also wrapped up my 100 Days of Palm Trees project! It was a challenge because I usually have such difficulty sticking to one thing. It became part of my daily routine, keeping me inspired to find unique compositions and feeling connected to using social media in a positive way.

Should I make these available for purchase? I need online printing suggestions. It seems as if there are many options out there. They can be printed at 8 x 8” without loss of detail. I’d prefer the traditional high-quality route rather than what many basic services provide just by connecting to my Instagram account via API. Prove me wrong.

Now that I have a little extra free time, I can spend more of that on these letters. For me, even if I’m doing 10-20 min here and there, I can make substantial progress over the course of the week. Which leads to one of my favorite all-time quotes:

“Inspiration is for amateurs. The rest of us just show up and get to work” ― Chuck Close

Lastly, if you just joined, I made some time available to talk in the form of creative therapy. I only had one time slot left, but I opened up two additional slots if you’re feeling stuck. I’m going to keep seeing where this leads since I’ve seen a little traction. It’s scary, especially for me, but sometimes we need a nudge.

Now on to this week’s letter…

Saving sucks

"You have just told me to save 20% of my money. Fuck you.”— A random podcast

Growing up, my first computer was the Apple IIe. Then later, our uncle helped us build some hand-me-down PC’s running 286 and 386 processors. When I was 15, I got into building my own towers, buying parts from stores with household names like Computer Renaissance and General Nanosystems. Even Tran Micro had a great selection.

Remember them? I didn’t think so.

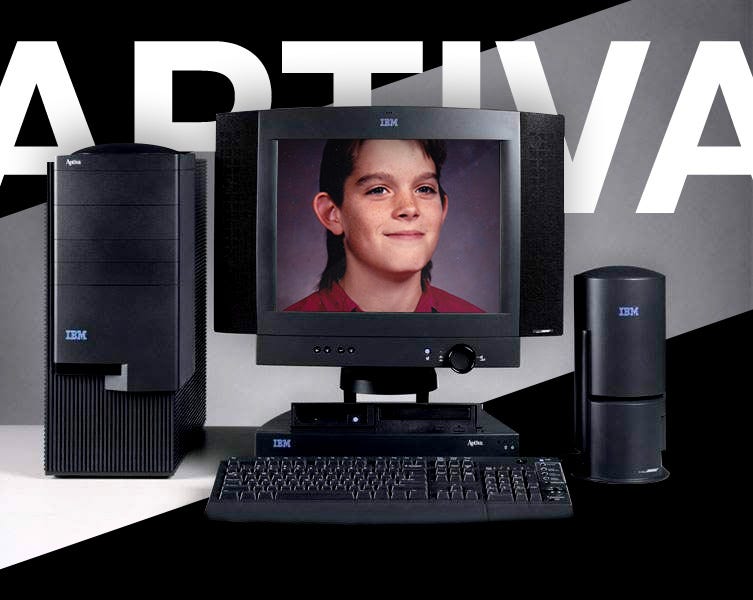

But when I was 17, I wanted a state-of-the-art, mother fucking PC. The IBM Aptiva. Drool over these stats: Pentium II, 266 Mhz, 8x DVD-ROM, 32MB RAM, built-in speakers. What!

It was black, it was fast, and it was an on floor-display at Circuit City. But, it cost around $3,000 and that was going to require many more photo shoots of crying newborns at ProEx if I ever wanted to afford this gorgeous piece of circuitry.

The IBM Right Start Loan

AKA “Let’s find some chump who we can charge 67% more over the course of the loan.”

Growing up, I didn’t learn great savings habits, but expecting anything different would have been extremely unique. Previous generations didn’t have the same types of mortgages, or consumer credit lines available at their fingertips. Student loans were not even close to the same as they are today, if at all. Families depended on their pensions. In short, we live in a much different world.

I was horrible at saving growing up,. I was always trying to figure out how to get paid, and promptly spend it. One time, I devised my own chore list that somehow my parents agreed to, charging them for each task accomplished. I argued that it was instilling a motivation to go above and beyond my normal chore work. It seemed reasonable. Both parties agreed.

50 executed chores later—each paying out roughly .40 cents— resulted in an invoice of about $20 placed in their hands.

They paid half, most likely to save face and chalk it up to a teaching lesson. For them.

I was good at coming up with side hustles, but I really had no grasp of how money works, and how easily you can be taken advantage of by people who know more about it than you.

Needless to say, over the next 5 years, that loan from IBM ended up costing me over $5,000. 2 of the last 5 years of the loan, the computer was sitting in its little proprietary shell that was not only non-upgradeable, but attracting dust.

Lacking sensibility

In my 20’s, I saved the bare minimum; having really nothing to show for all the work I was doing. I had no idea what I was doing, and I was spending every dollar I made. I had very little saved.

My 30’s started with a bang. I had saved up the bare minimum to buy a home, thinking real estate was the right approach. Remember my last letter about asking questions? The mistake I made when deciding to buy a home started by asking the wrong questions. I should not have asked a bunch of homeowners—or worse; a real estate agent—if I should buy a home. I could have made much better decisions if I weighted their answers more appropriately.

But I said, “Screw it, this seems smart” and bought it anyways—getting seriously lucky by purchasing after the crash—then abruptly stuffed it with things that definitely did not make me happier.

This went on until I sold the condo (losing the 10% down payment with fees + misc) and decided I was soon becoming a renter for life, at least for the foreseeable future until I learned more about this thing called money. But my story about renting is for another letter.

After selling, I moved in with a friend and rented a room in his house, giving away most everything.

This isn’t a story about minimalism, but I think I needed a reset at 33 to really understand what I should be doing with my money and preparing for the future.

Then I decided to figure this shit out.

“Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn't… pays it.” —Albert Einstein

The first book I bought on the topic was, The Coffeehouse Investor. It was recommended and sounded similar to what my life was like at that point.

I started learning about the boring side of investing and started to understand low-fee index funds. I got serious about saving and started to read more books like The Four Pillars of Investing, Your Money & Your Brain, The Bogleheads' Guide to Retirement Planning, The Bogleheads' Guide to Investing and plenty more.

One thing was clear to me. As dire as my situation was, history gives plenty of examples of others who had been in my shoes. I wasn’t the first to fuck up.

Fear prevents growth

I remember trying to exchange notes with a friend about money, and I was basically told, “I don’t think we should talk about it.” I have no idea what their situation was, but it also prevented both of us a chance at learning from one another.

There is so much fear surrounding money and how we talk about it. That usually means that we’re left to educate ourselves, or god forbid, pay someone a percentage who isn’t bound by fiduciary laws to look after your money.

But, one thing that I have learned—and truly do my best to abide by— is to not have debt, and do not live above my means.

Saving is like dieting. It’s easier not to eat that 500 calories than it is to try and work it off. Cut your spending and you just saved that much more.

Debt prevents clarity

If you’re anything like me, we’ve made plenty of mistakes. But when I was in debt, it really impaired my decision making because it was such a weight. It was always there at every purchase. Thankfully, I let the punches hit me in the face to remind what I needed to do. The worse thing would have been to deftly dodge the punches while the debt stacked up.

If you’re in debt, stop spending more than you earn and pay that shit down.

I don’t think I could have pursued many of my own ideas if I had been swimming in debt. It’s the one thing that has enabled me to stay flexible and try new things.

It’s so tough to start a new project, launch a side business, or look ahead if you’re stuck in debt. It suuuuucks.

Simple steps by someone smarter than me

Harold Pollack, a professor at the U of Chicago, started to study and interview financial advisors to figure out best practices, and publicly distilled what he learned onto an index card, the posted it online. It was incredibly simple and popular. Then he wrote a book about it. If you don’t know where to start, here are 9 steps that Pollack describes, which is very similar to what I do. But really, pay your debt down first and build good habits.

The original card

Save 10-20% of your gross income.

Pay credit card balance in full every month.

Max out your 401k and other tax advantage savings accounts.

Never buy or sell individual stocks.

Buy inexpensive, well-diversified index mutual funds and exchange-traded funds.

Make your financial advisor commit to the fiduciary standard.

Buy a home only when you’re financially ready (Minimum 20% down and when you plan on living there > 7 years).

Get insured (with high deductibles to protect the catastrophic events).

Do what you can to support the social safety net.

How I live debt free in an expensive city

For almost 5 years now, I started to budget like a maniac. I’ve tried several methods, but they all placed too much control over how I spend. I needed something that could flex, would adapt to my spending habits, but give me a real insight into how I was using my money.

I found You Need a Budget early on, and I’m forever grateful (and hooked). It clicked as soon as I read their first rule: Give every dollar a job.

If you look at every dollar you have right now, it has a job to do. Whether it’s today, tomorrow, or next month. If you’re lucky to have banked cash past 30 to 60 days, those dollars still have jobs. It’s up to you in how they are spent, but you can plan for that happens. Especially for those minuscule things like car registration fees at the end of the year.

The other important thing to know is that it doesn’t matter if you have money in 6 different accounts. You’ll realize that it doesn’t matter where your money is. As long as you aren’t paying high fees, just ignore all that and stop trying to find the bank accounts trying to give you .05% more than the next guy. Inflation is 2% per year, so unless you found a magical savings account, you’re burning cash in an accessible checking account anyways.

If you are looking for something similar for yourself, check it out. If you have questions, reach out or try their incredibly receptive help center.

You Need a Budget (The cool kids call it YNAB; why-nab)

Money is going to get spent. When I lived in MN, I spent the money on going out and eating wherever I wanted. Now, we cook everyday and go out about twice a month. We just spend most of our money on rent. But, it’s getting spent either way.

Resources

Bogleheads Forums (Named after John C. Bogle - Founder of Vanguard)

YNAB - Personal budgeting site

Money: Master the Game — Tony Robbins

What I Learned Losing a Million Dollars — Brendan Moynihan

The Millionaire Next Door — Thomas J. Stanley Ph.D.

I Will Teach You to Be Rich — Ramit Sethi

And SO many more! Hit reply and let me know if you want more.

A question for you

What was the worst investment or financial story that you have to share? Or, what kinds of good/bad habits do you have when it comes to saving?

I’ll respond with one of my stories.

Have a great week,

Nate

This is Plan Your Next. It’s a conversation about being ready for what’s next. Well, because there is always a next. I’m Nate, designer and conductor of this group.

If you have something to share or add, please hit reply and expect a response!